Learn About (Your) Money this January

If your goals for 2023 include wrangling your personal finances, the library can help you with access to free educational resources and workshops.

Events

STEAM Emporium (All Ages) – January 21 at 3pm at Schimelpfenig Library

Can you solve a problem with $5.00? Use play money to purchase materials at our STEAM Emporium to complete a STEAM challenge and learn decision-making skills. This is a ticketed event – get your free ticket in person up to 30 minutes before the event begins.

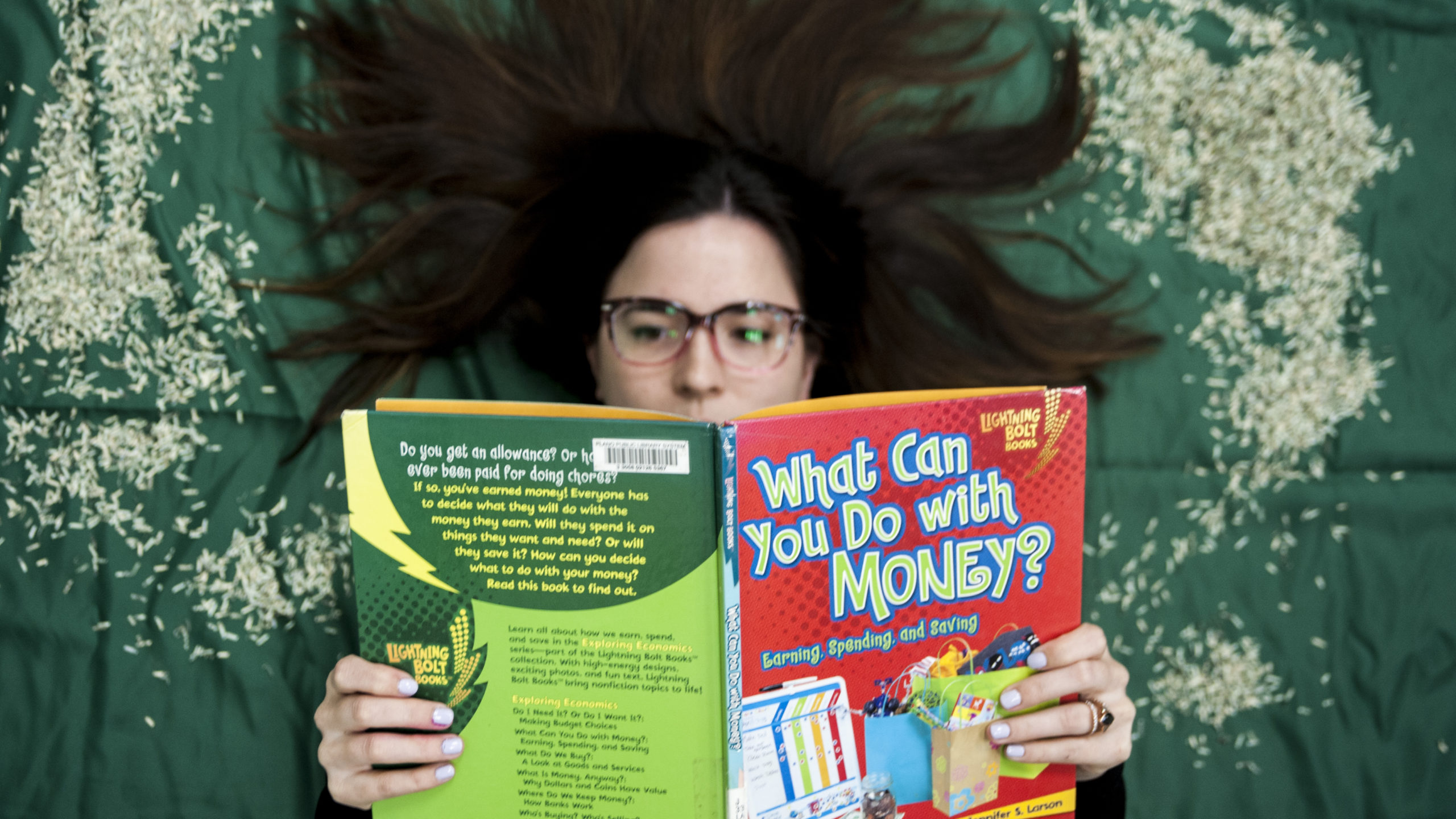

A Plan for My Money (All Ages) – January 22 at 2pm at Parr Library

Wonder how money works? Learn how through activities about earning, spending and saving your money. This is a ticketed event – get your free ticket in person up to 30 minutes before the event begins.

Pay Down Debt or Save? (Adult) – January 27 at 12pm – Virtual

How do you decide what’s more important—paying down debt or building up your savings? Learn the five questions to help figure out the best steps for you. Presented by Bank of America. Register for this virtual program.

Building Wealth: Financial Basics for Teens (Grades 6-12) – January 29 at 2pm at Haggard Library

Do you know how much basic living expenses cost? Learn basic financial concepts and develop a plan to reach your short and long-term financial goals.

Books

Here are some of the latest titles added to the collection on personal finance

My Money my Way: Taking Back Control of your Financial Life by Kumiko Love Print

My Money My Way will give you the tools to align your emotional health with your financial health-to let go of deprivation and embrace desire. Love’s paradigm-shifting system will teach you how to honor your unique personal values, driving emotions, and particular needs so that you can stop worrying about money and start living a financially fulfilled life.

Balance: How to Invest and Spend for Happiness, Health, and Wealth by Andrew Hallam Print

In this illuminating guide to living a financially healthier and happier life, bestselling author and finance journalist Andrew Hallam demonstrates how you can optimize your income for maximum happiness by investing responsibility and living according to your values.

Teen Guide to Financial Literacy by Joseph Ferry Print

How you learn how to handle your money now will go a long way in determining which financial track you will take in life. Financial literacy is generally defined as having the right habits and knowledge about money that lead to financial security and the ability to weather an unexpected emergency expense.

Online Resources

The library is, of course, #MoreThanBooks! We have a whole host of online resources available to library cardholders. Here are a few online resources to boost your financial literacy knowledge.

Morningstar Investment Research Center

Investment resource specialized in fund investing. Offers news, commentary, fund information, tutorial, tools and forums. Publishers of annual reports and more. The Library subscription only allows a limited number of concurrent users. When you log off, please click the End Session link to allow others access to the database. Access Now.

Udemy

Udemy is one of the latest resources available from Plano Public Library, and includes dozens of online classes on personal finance. Here are a few:

- The Complete Personal Finance Course: Save, Protect, Make More (16.5 hours)

- Acorn’s Guide to Personal Finance (1 hour)

- Personal Finance Masterclass – Easy Guide to Better Finances (7.5 hours)

- The Core Four of Personal Finance including Recession Basics (5.5 hours)

Udemy requires that you make an account to access courses. Learn more in our Quick Reference Guide (PDF). Access Udemy here.

Value Line

Provides information to help you evaluate 3,500 of the most actively traded stocks in more than 100 industries, representing 95% of the daily US trading volume. Access Now