Financial Literacy: Achieve Your New Year’s Goals

Meet and beat your financial goals this year with resources from Plano Public Library.

2022 is right around the corner! The new year is the perfect time to set new financial goals for yourself. Whether your resolution is to make and stick to a budget, start investing or get ready for retirement, Plano Public Library offers resources to help you along the way. Check out some options below!

Create and Stick To Your Budget

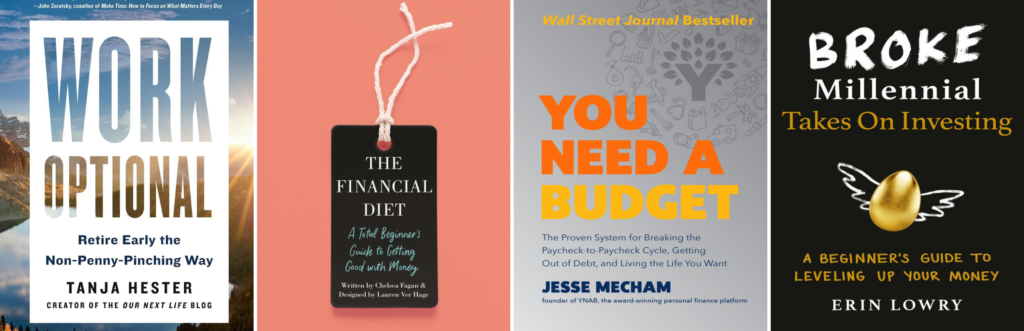

The Financial Diet: A Total Beginner’s Guide to Getting Good with Money by Chelsea Fagan: Whether you’re in need of an overspending detox, buried under student debt, or just trying to figure out how to live on an entry-level salary, The Financial Diet gives you tools to make a budget, understand investments, and deal with your credit. Chelsea Fagan has tapped a range of experts to help you make the best choices for you, but she also knows that being smarter with money isn’t just about what you put in the bank. eBook | Print

Money Hack$: 275+ Ways to Decrease Spending, Increase Savings, and Make Your Money Work for You! by Lisa Rowan: Are you looking for ways to decrease your spending…and start increasing your savings? Need some simple advice for maximizing your investments? Want to start planning for your retirement but don’t know where to start? It’s now easier than ever to achieve all your financial goals! Many people are afraid to talk about money, which means that you might be missing some of the best money-saving skills out there! In Money Hacks you will learn the basics of your finances so you can start making every penny count. Whether you’re trying to pay down debt, start an emergency fund, or make the smartest choice on a major purchase, this book is chock-full of all the useful hacks to make your money work for you in every situation! Print

Get Good with Money: Ten Simple Steps to Becoming Financially Whole by Tiffany Aliche: Introducing the powerful idea of striving for financial wholeness instead of early retirement or millionaire status: learn the ten short-term steps that lead to long-term security. From the simple (best practices for budgeting and saving) to the more sophisticated (investing, taking charge of your credit score, and calculating your insurance needs), use memorable stories, actionable lists and worksheets, and a you-got-this attitude, to build a solid foundation for a life that’s rich in every way. eBook | Print

You Need a Budget: The Proven Cycle for Breaking the Paycheck-to-Paycheck Cycle, Getting out of Debt, and Living the Life You Want by Jesse Mecham: A guide based on the tenets of the “You Need a Budget” financial platform argues that a well-planned budget can help to prioritize financial goals, reduce stress through strategic cash flow allocations, and meet the challenges of unplanned expenses. eBook | Print

Solve Your Money Troubles: Strategies to Get Out of Debt and Stay That Way by Amy Loftsgordon: Conquering overwhelming debt starts with understanding your options. Loftsgordon and O’Neill give you the tools you need to get your finances back on track. They provide up-to-date legal information, as well as sample creditor letters and budgeting worksheets. Print

Begin Investing

Personal Investing: The Missing Manual by Bonnie Biafore: Your financial goals probably include a comfortable retirement, paying for your kids’ college education, and long-term healthcare. But you can’t reach those goals by putting your money in a savings account. You need to invest it so it grows over time. Three seasoned personal finance experts show you how in this jargon-free guide. Print

Broke Millennial Takes On Investing: A Beginner’s Guide to Leveling Up Your Money by Erin Lowry: Tackling topics ranging from common terminology to how to handle your anxiety to retirement savings and even how to actually buy and sell a stock, this hands-on guide will help any investment newbie become a confident player in the market on their way to building wealth. eBook | Print

The Little Book of Investing Like the Pros: Five Steps for Picking Stocks by Joshua Pearl: We believe the simplicity and accessibility of our stock picking framework is truly unique. Using real-world examples and actual Wall Street models used by the pros, we teach you how to pick stocks in a highly accessible, step-by-step manner. Print

The Coffeehouse Investor’s Ground Rules: Save, Invest, and Plan for a Life of Wealth and Happiness by Bill Schultheis: Encourages readers to ignore stock market “rules” and “perfect portfolio” pursuits to focus on the only three essential components to long-term financial security: saving, investing, and planning. Print

Invest Like a Guru: Using Value Investing to Evaluate Companies and Generate Higher Returns with Smaller Risk by Charlie Tian: Provides an invaluable resource for high-quality-focused value investing, with expert insight and practical tools for implementation. Written by the man behind GuruFocus.com, this book expands on the site’s value strategies and research tools to provide a primer for those exploring pathways to higher returns at lower risk. Print

Prepare for Retirement

Your Complete Guide to a Successful and Secure Retirement by Larry E. Swedroe: Presents uniquely comprehensive coverage of every important aspect you need to think about as you approach retirement, including: Social Security, Medicare, investment planning strategy, portfolio maintenance, preparing your heirs, retirement issues faced by women, the threat of elder financial abuse, going beyond financials to think about your happiness, and much more. Print

Retirement Reinvention: Make Your Next Act Your Best Act by Robin Ryan: This book helps you create a plan and pivot toward a fun, meaningful future in retirement. Print | Large Print

The Five Years Before You Retire: Retirement Planning When You Need It the Most by Emily Guy Birken: Most people don’t realize they haven’t saved enough for their retirement until their sixties and by then, it’s often too late to save enough for a comfortable retirement. The 5 Years Before You Retire has helped thousands of people prepare for retirement-even if they waited until the last minute. Print

Retirement 101: From 401k Plans and Social Security Benefits to Asset Management and Medical Insurance: Your Complete Guide to Preparing for the Future You Want by Michele Cagan: A comprehensive and easy-to-understand guide to the ins and outs of retirement planning–the key resource for creating a retirement you can live on! Print

Work Optional: Retire Early the Non-Penny-Pinching Way by Tanja Hester: A practical action guide for financial independence and early retirement from the popular “Our Next Life” blogger. Print

We hope that these resources help you on your financial literacy journey. Check out more of our Thinking Money posts, including booklists. You can find all of these and more at your local Plano Public Library